- What is an API?

- What is an API in Open Banking?

- How Do Open Banking Platforms Work?

- How Open Banking is Revolutionizing Finance

- Are Open Banking APIs Safe?

- Four Benefits of Open Banking APIs

If you’re wondering how Open Banking APIs work and how they’re transforming finance, you’ve come to the right place. Open banking stands for the consumer’s right to share their financial data with third-party financial service providers, and Open Banking APIs and open banking platforms are designed to support this right. Read on to learn more.

What is an API?

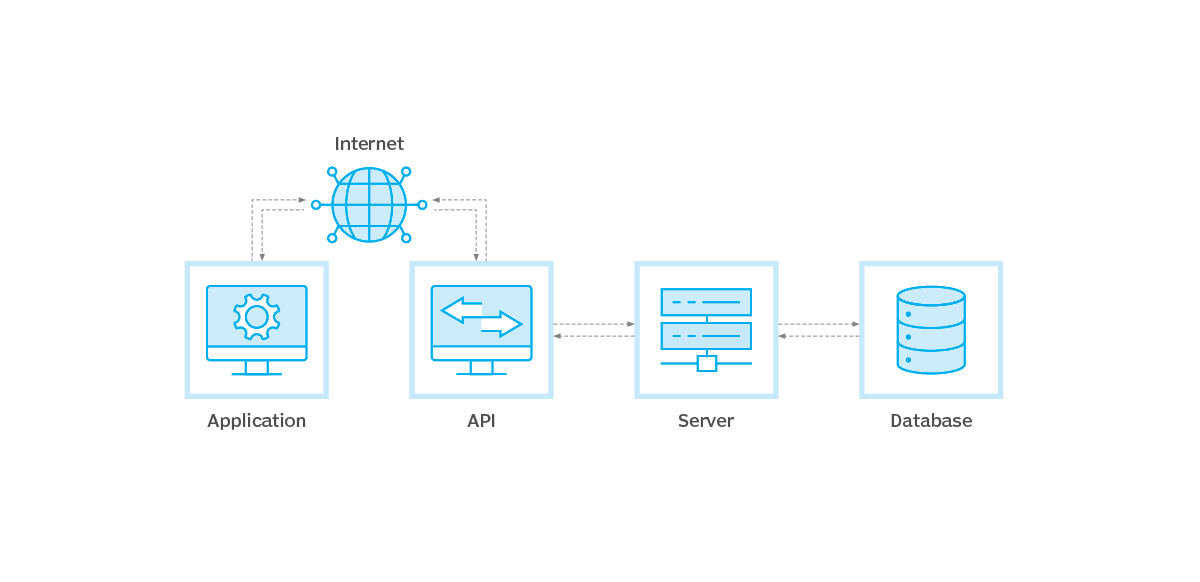

APIs have been around almost as long as computers have, and they’re used in all industries. An API, which means Application Programming Interface, acts as an interface between two applications so they can communicate with each other. In other words, an API submits your request for data or services to the provider that you’re requesting it from, and then delivers the response back to you.

Banking and finance APIs work like regular APIs, only they leverage consumer-permissioned banking data. By using a banking API, technology providers and banks can gain seamless access to timely financial and account information to quickly connect and verify financial accounts to prevent fraud, confirm balances, obtain a holistic picture of a client’s financial situation, uncover financial insights for more strategic financial advice, and more.

How an API works

What is an API in Open Banking? Open Banking API?

Open banking APIs facilitate open banking by enabling financial institutions to seamlessly share financial data, typically through a third-party-developed application. Banking API providers such as emerging FinTech companies and collaborators create these applications to improve traditional banking systems and make the digital banking industry better for everyone.

How Do Open Banking API Platforms Work?

Open API banking platforms allow communication between two different applications, typically one from a FinTech provider and the other from a financial institution.

As an open-source financial data platform, the Open Banking Project (OBP) enables financial institutions to share their data with emerging FinTech firms to develop new open banking APIs and digital banking technologies. By partnering with FinTechs through OBP, financial institutions are enriching their own data and creating a more competitive market for industry services and products.

How Open Banking is Revolutionizing Finance

Mobile banking trends and the widespread availability of financial data through banking APIs are resulting in the development of innovative new products and services that empower financial wellness, expand access to credit to those with limited credit histories, and more. Open Banking APIs enable the banking industry and FinTechs to optimize digital banking experiences and grow customer experiences, expand revenue streams, solutions, and market influence. Learn more about the open banking movement

Open banking powers:

- Broader access to responsible credit, including credit cards and nano-loans

- Broader access to a wider variety of insurance products, including micro-insurance

- Participation in the global economy, by enabling users to securely move beyond cash-only transactions

- Access to affordable financial tools that address accounting and cash management for small businesses and/or budgeting and personal finances for individuals

See more ways open banking is transforming finance

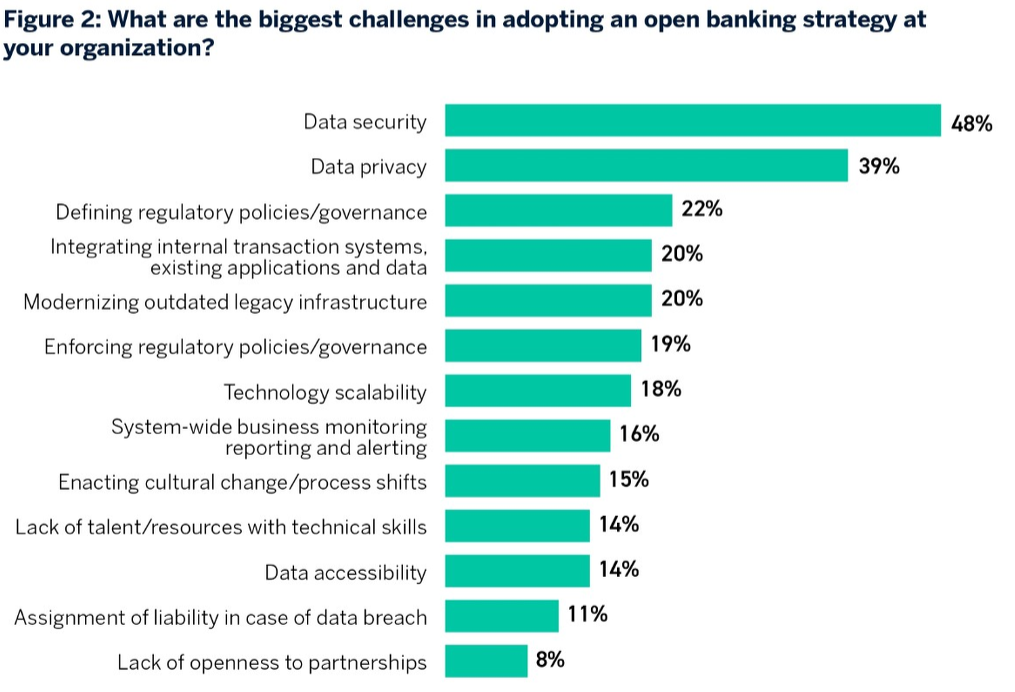

Expectations about the customer experience have grown as digital banking has become widely accepted. The majority of financial institutions believe open banking will reshape the financial services industry over the next 10 years, though there remain challenges for open banking adoption within organizations. Download the Open Banking: A New Frontier Whitepaper to learn more.

Are Open Banking APIs Safe?

As open banking expands, the security of financial data is a primary focus for financial institutions and FinTech firms alike. They both must meet regulatory rules and requirements in order to share their open API banking platforms, so they share a deep interest in providing customers with the most secure banking experience possible.

Open banking promotes the establishment of uniform security standards for data access, transparency around data usage, and user-based permission and control. The EU adopted the Revised Payment Services Directive (PSD2), for instance, to allow third-party providers to access financial data with consumer permission to improve universal security standards while encouraging innovation across the banking industry. Learn more about Open Banking PSD2.

Benefits of Open Banking APIs

The advantages of using open banking APIs to connect to consumer-permissioned data include:

Improved success rates for linking accounts

Open banking success rates for adding accounts are higher because users are logging in directly on their financial institution’s site. One-time password codes, if required, are sent from and received directly by the financial institution rather than being relayed through an application.

As of 2023, a number of financial institutions have discontinued screen scraping access altogether. This means that it’s no longer possible to link an account for those institutions through credential-based methods, and open banking is the only allowed path.

Higher account refresh rates

Open banking refresh rates are higher because the data connection in open banking is via a direct API. In addition, the data is accessed with an OAuth ‘token’ that is not affected by user password changes or multi-factor authentication requirements.

Faster performance

A direct API data connection is also inherently faster than a credential-based access data agent that must navigate/trawl the online website for data. The login process may also be faster due to less time lost to multi-factor authentication requirements.

Increased engagement

Once the account linking connection is broken for any reason, it becomes more difficult to provide a user experience that engages the consumer and keeps them coming back to use the app. For example, an app that tracks spending against a budget relies on having up-to-date transaction details to display helpful information and alerts. When the data is frequently out of date or requires re-linking, consumers will tend to drop off. With open banking, the connections are more reliable, enabling an optimal consumer experience.

Improved resiliency

Once the account linking connection is established through open banking, it is an API-based server-to-server link that is unaffected by front-end site issues including IP blocking and multifactor authentication. The open banking connection is one that can be maintained with higher resiliency.

See more Open Banking API benefits [link to The Success Metrics of Open Banking datasheet]

Envestnet | Yodlee’s Open Banking API

As an independent financial data aggregator with a diverse customer base composed of financial institutions, wealth management firms, FinTechs, and other innovators, Envestnet | Yodlee enhances access to consumer-permissioned data through our innovative open banking platform. Our open banking API solutions leverage data from bank accounts and sources such as insurance, investments, and more. This depth and breadth of this data combined with our open banking expertise and cutting edge tools enable financial service providers and non-banking innovators to deliver competitive solutions that support financial wellness for all. Learn more about our open banking platform.